One of the criticisms of Porter’s Generic Strategies and Industry Mapping is that the positions are essentially defined by the firms in an industry rather than from the customer’s perspective. While many firms in an industry want to set their own competitive strategy and position, the fact is that many of those firms do not. Rather than plot their own fate, they instead react to the market. Their strategy emerges rather than gets planned. And while many facets make up any market, the major ones to consider here are the firms in the industry and the customers of that industry.

Taking a customer-centric view of competitive positioning therefore makes sense in order to incorporate the perceptions and opinions of the customers.

A model I like to use to overlay Porter’s Generic Strategies that takes this customer-centric view was developed by Michael Treacy and Fred Wiersema in the mid 1990s, and described in their book The Discipline of Market Leaders. This model is a useful framework for business owners to better understand and improve their competitive strategy. We will here refer to the model as T&W for brevity.

Overview of the T&W Model

The T&W model can be used to help identify and focus the business on their core strengths to achieve a competitive advantage in the market. The authors state that there are three fundamental value disciplines, and companies should excel in one of these disciplines to gain a competitive edge. The three disciplines are Operational Excellence, Customer Intimacy, and Product Leadership.

Operational Excellence

Companies that focus on operational excellence aim to deliver their products and services at the lowest price and with the highest efficiency and reliability in their industry. This discipline requires streamlining processes, reducing waste, and optimising the supply chain. Businesses following this discipline typically provide reliable and standardised products or services.

While this discipline is similar to Porter’s Low Cost position, it is not the same. Cost is what the firms in an industry measure and compete on. Price is what customers see and care about. Cost leadership tells us nothing about price. Nonetheless, it can be strategic suicide to try and lead on price when you do not enjoy the cost leadership position.

The core customer group for this discipline are the mass market that don’t place a premium on whizzy toys or excessive levels of relationship. This is the domain of the mass-producers offering perfectly acceptable goods at the lowest price. Relationships with these customers are highly transactional and price driven.

Customer Intimacy

Businesses following this discipline prioritise building strong relationships with their customers. They aim to understand their customers’ needs deeply and offer highly customised products and services. Customer intimacy requires ongoing engagement, personalised solutions, and excellent customer service.

Your customers here place a high value on the relationship, and are willing to pay more for it. They still expect a good product – you can’t cut corners just because your customers are loyal.

Product Leadership

Firms that excel in product leadership constantly innovate and offer cutting-edge products and services. They invest heavily in research and development to stay ahead of competitors. This discipline requires a focus on product quality, uniqueness, and staying at the forefront of industry trends.

You will be recognised as the leader in your market in terms of the offering. Your customers are innovators and early adopters. They are willing to take risk on innovative offerings to keep them ahead in the market. Leaders here invest in R&D (and open sourcing) and effective productisation to get these innovations to market.

Applying The Model

Treacy & Wiersema outline how to use this model in your business.

- Identify Your Primary Value Discipline: Consider your business operations and determine which of the three value disciplines best aligns with your firm’s strengths and competencies. This is not an aspirational position – it is an assessment of how you can best compete in your industry. The T&W model requires you to lead in your chosen discipline. Being second-best is not a leadership position.

- Set a Goal to Lead in Your Chosen Discipline: Once you’ve identified your primary value discipline, develop the specific strategy to become the leader in that discipline. For example, if you choose operational excellence, you would focus on cost-cutting, streamlining, efficiency, and reliability. If you opt for customer intimacy, you would prioritise building the strongest customer relationships in the industry and provide highly personalised solutions. For product leadership, you need to invest in innovation, product development, and technology to have the leading offering in the market.

- Align Resources and Activities: Allocate your firm’s resources and efforts to support the selected value discipline. This is an holistic retooling, from hiring and training employees, investing in new technology, and refining your processes accordingly.

- Measure and Adapt: Build your customer base around those who want what you are offering. Don’t try and win over clients that want one of the other disciplines. Then, continuously monitor your performance and customer feedback. Adjust your strategy as needed to maintain or improve your competitive advantage.

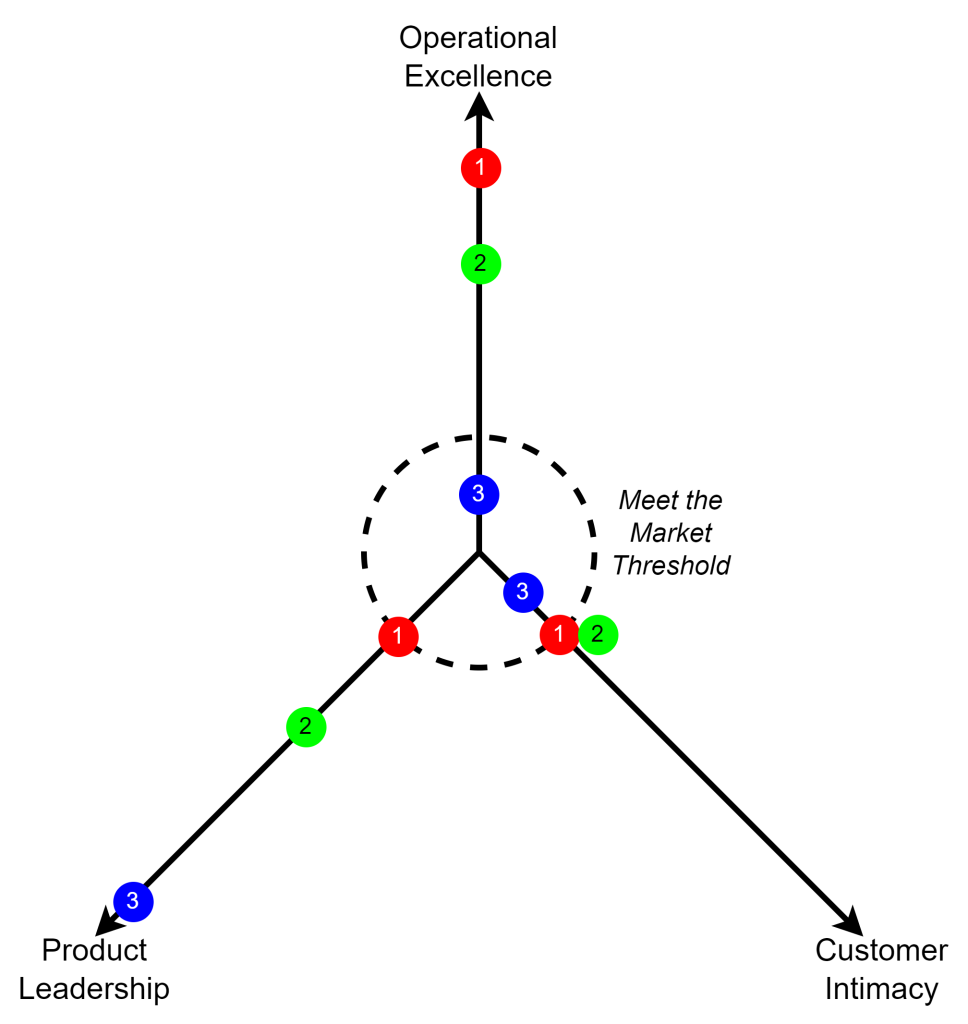

This is quite a simple model as originally presented, but one that benefits from an illustration.

Start with the three disciplines. While each is an axes, the three axes are not a 3D illustration. Think of them like a spider diagram – flat. Firms can only be positioned on the axes, not in the spaces between. Each axes is relative rather than absolute. There are no real units associated with each axes.

Near the centre of the diagram is the dotted-line circle. This represents, for each of the axes, the meet the market level for that discipline – the minimum level the market will accept in that discipline. Again, this is a relative, indicative position. There is no scale on any of the lines.

When considering the positioning of a firm, we mark where that firm sits on each axis. Take Firm 1 (the red dots). This company sits all the way up the Operational Excellence axis, and exactly on the meet the market position in the other two axes. As long as no other firm in that industry is considered more Operationally Excellent, Firm 1 would be the leader in this discipline in this industry.

Now look at Firm 2 (the green dots). This company is high on the Operational Excellence axis, but not as high as Firm 1. It sits above the meet the market line on Product Leadership (but above Firm 1), and meets the market on Customer Intimacy. How is this firm positioned? Well, poorly: It isn’t the leader in any discipline, and is giving away value in one of the disciplines. This is a strategic mistake in two ways: they don’t – in the eyes of their customers – lead in any axis important to their customers. Being second-best in your chosen discipline puts a firm under a lot of competitive pressure from the leader in that axis. So, let’s say Firm 1 is the least expensive offering in this market, appealing to the mass market buying on price. Firm 2 is not the cheapest. So why would a customer buying on price select this offering?

You don’t get to make up for a weakness in one axis by over-performing in another – unless you lead that other axis, of course. But Firm 2 doesn’t lead in Product Leadership. They are a bit stuck in the middle, not leading in any axis of importance to customers. This firm may survive, but is unlikely to thrive in this market.

Finally, let’s look at Firm 3 (blue dots). Firm 3 is the leader in Product Leadership, appealing strongly to early adopters. Where this firm fails is that they are inferior goods, sitting below the Meet The Market line in the other two axes. This means they don’t make the grade. No matter how strong they are in their primary discipline, this strength will not make up for the fact they fail in these other aspects. An example of this might be an electric car company that has the best, most whizzy features that lead the market, but the car crashes every week, is twice the price of the next best car that actually works, and they don’t have any after-sales service.

This illustration demonstrates how the model is used. Keep in mind the concept is about strategic leadership. Even really bad products and services get some customers, but if they are not the leader in any axis, and/or are inferior in any axis, they are doomed to a very hard existence. Or they will fail.

Making T&W Work

For the T&W approach to positioning to work successfully, you need to keep the following factors at the forefront of your thinking.

First, consistency of strategy is key. Here, that means you need to consistently deliver value in your chosen discipline. Don’t spread yourself all around the playing board, and don’t change your selected discipline too frequently. Lack of consistency confuses your customers and dilutes your messages to the market.

Regardless of your chosen discipline, you always need to prioritise your understanding of what your customers are seeking, and then lead in that discipline.

Do not ignore what your competitors are doing, even where their (apparent) chosen position is different to yours. Competitively, you can undermine others in your industry by giving away value. This is a common response, and you need to be aware when it is happening in your market.

Similarly, you need to stay on top of what is happening in your market as a whole. Each discipline will evolve over time, and you need to be ready to move with it. In general, you will maintain your chosen discipline, but in some cases you may be forced to change. But, as I said above, don’t change your discipline too often (if at all).

Finally, you need to consider how you effectively allocate your budget and resources. Focusing on the one selected value discipline requires different resource allocation compared to others. In particular, you need to tune your business so that you meet the market in the other value disciplines while leading in the chosen discipline. In other words, you provide the bare minimum competitive necessity level in order to stay in the market in these other disciplines. Failure to maintain this threshold level of performance is a common error I see firms make.

Common Mistakes

In addition to failing to maintain the minimum market expectations in the other disciplines, there are some common mistakes I see firms make when developing their competitive position. Now, my lens here is considering what a firm’s strategy appears to be from the outside. In other words, I am guessing. Further, my experience is that very few firms actually have used a reference model like T&W to develop their strategy.

One major mistake I see is the belief that strategy is set by your marketing team. This notion is so embedded in many firms that they believe marketing is strategy. I do not buy into this. Strategy is set by you, the owner, or by your senior management team. Marketing has a role, but so does pretty much every part of your business. I don’t even consider that the firm’s Competitive Position sits solely (or largely) with your marketing team. This is a debate I have had many times with marketing folk.

Another common mistake I see is that firms select the discipline they want rather than the one in which they can actually lead.

The biggest mistake, overall, with positioning however, is the failure to excel at anything. This was a common problem identified in the application of Porter’s Generic Strategies: firms that are ‘stuck in the middle.’ Firms that try and be all things to all people, or lack the focus they need, and therefore chase every client opportunity, ignoring whether that client is a fit or not.

Treacy & Wiersema’s Competitive Positioning Model offers a simple and practical way for small business owners to determine their competitive strategy and differentiate themselves in the market. By identifying and excelling in one of these three value disciplines, businesses can strive for a sustainable competitive advantage within their industry.

But, this isn’t the complete picture. What I have discussed here outlines the generic T&W model. Next, I will explore how this model can be developed to apply to pretty much any market.